karbonfunkc.io

Source: TIST sites, Tanzania, courtesy of Digitalglobe

Source: TIST sites, Tanzania, courtesy of Digitalglobe

What are carbon offsets?

Carbon offsets are a form of trade; they are a reduction in emissions of carbon dioxide or other greenhouse gases (GHG) made in order to compensate for emissions made elsewhere. When you buy an offset, you fund projects that reduce GHG emissions. These projects might include tree-planting, restoring forests, or increasing the energy efficiency of buildings. In an effort to combat climate change, individuals and companies can trade, or rather purchase offsets to assuage guilt, supposedly reduce their carbon footprint, and build up their green image.

“The website is the primary tool for carbon-offset firms…The aesthetic is usually spare, lots of white space and green lettering, with photos of towering windmills and resplendent banks of solar panels. The electronic pages are accented with what most people imagine when they think of nature: radiant flowers, waves crashing ashore, thickets of trees.”

Heather Rogers, Green Gone Wrong: Dispatches from the Front Lines of Eco-Capitalism

What is a carbon credit?

A carbon credit is a generic term for any tradable certificate or permit representing the right to emit one tonne of carbon dioxide or other greenhouse gas with an equivalent to one tonne of carbon dioxide. (tCO2e)

- Carbon credits were devised as a market-oriented mechanism to reduce the emission of greenhouse gases into the atmosphere.

- As noted, a carbon credit is equal to one ton of hydrocarbon fuel. According to the Environmental Defense Fund, that is the equivalent of a 2,400-mile drive in terms of carbon dioxide emissions.

- Companies or nations are allotted a certain number of credits and may trade them to help balance total worldwide emissions.

Source: Investopedia.com

Where did they come from? A brief history of carbon offsets

In 1992-94, the dangers of greenhouse gas emissions as a result of anthropogenic activity, were explicitly formalized with the creation of the United Nations Framework Convention on Climate Change (UNFCCC).1 The statement structured the culpability of “developed nations” as the largest contributors to climate change, and suggested an international economic framework that would fund carbon sink projects in all signatory countries.

This financial legislation was later formalized in the Kyoto Protocol (1998), by designating specific obligations to developed countries,2 and introducing the means by which equivalent emissions could be traded in order to fulfill commitments.

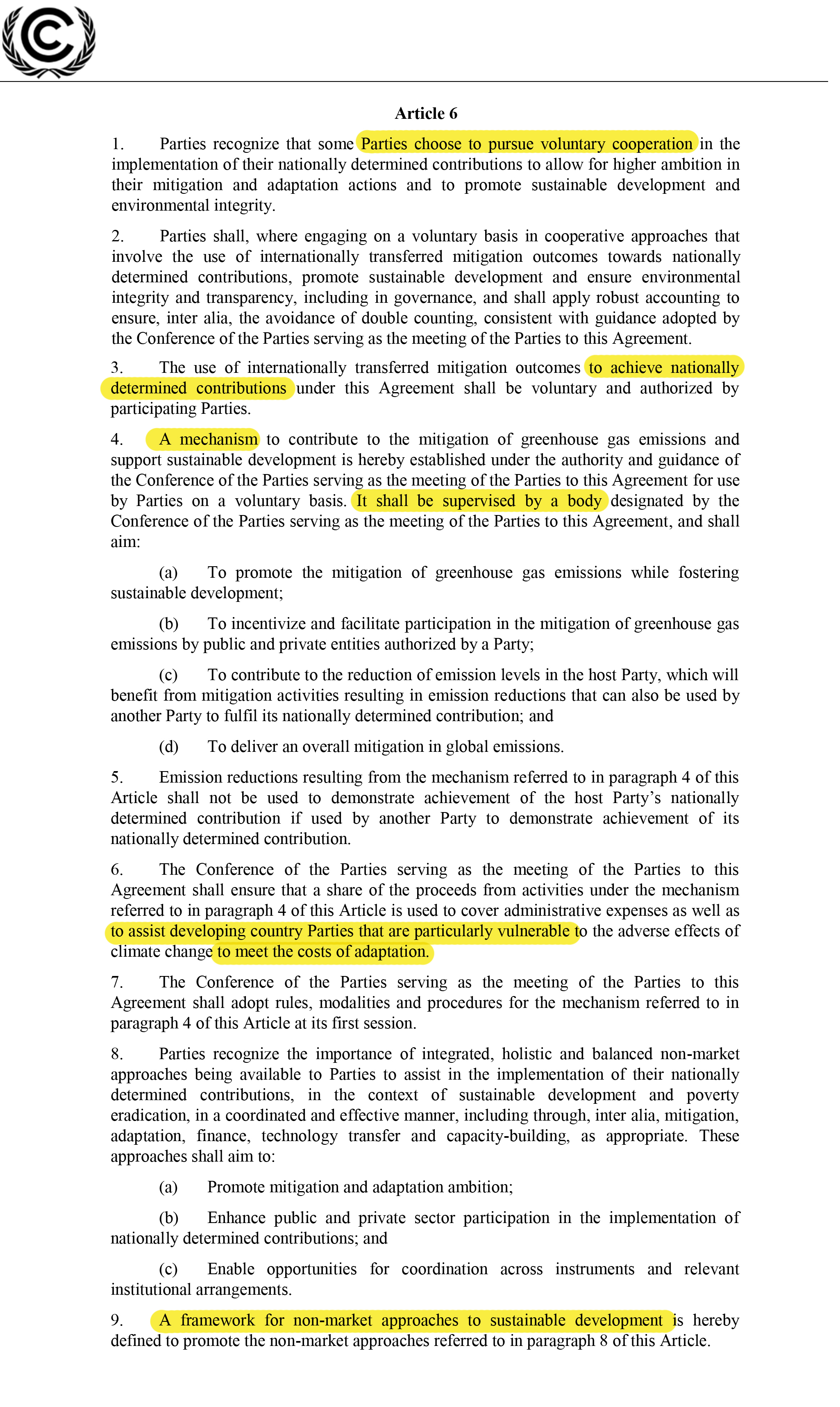

The Paris agreement of 2015 introduced a new ecological and financial protocol that followed suit. Under Article 6, a series of policies allowed the emissions trading market to expand to the “developing” nations, suggesting the use of internationally transferred mitigation outcomes towards nationally determined contributions”. This became the norm, formally shifting the platform to investment in projects based in “developing” nations, as an ecological capital colonialism.

Source: UNFCC Paris Agreement, Article 6, 12 December 2015, in accordance with article 21

Source: UNFCC Paris Agreement, Article 6, 12 December 2015, in accordance with article 21

In 2017, the US withdrew from the Paris agreement, in what is seen as a signature Trump action, but is actually consistent with the US position of economic strength over ecological commitments since the 1997 Byrd-Hagel Resolution.3 This removal of a formal commitment enables the private emissions trading market in the US to blossom, outside of any central regulatory or government entity. As such, the market is constructed around a moral obligation or ecological conscience of consumer actions. “Carbon Offsets” as we know them, become a series of one-time payments, an unregulated vehicle for individuals and corporations to attempt to displace their obligation toward sustainability.

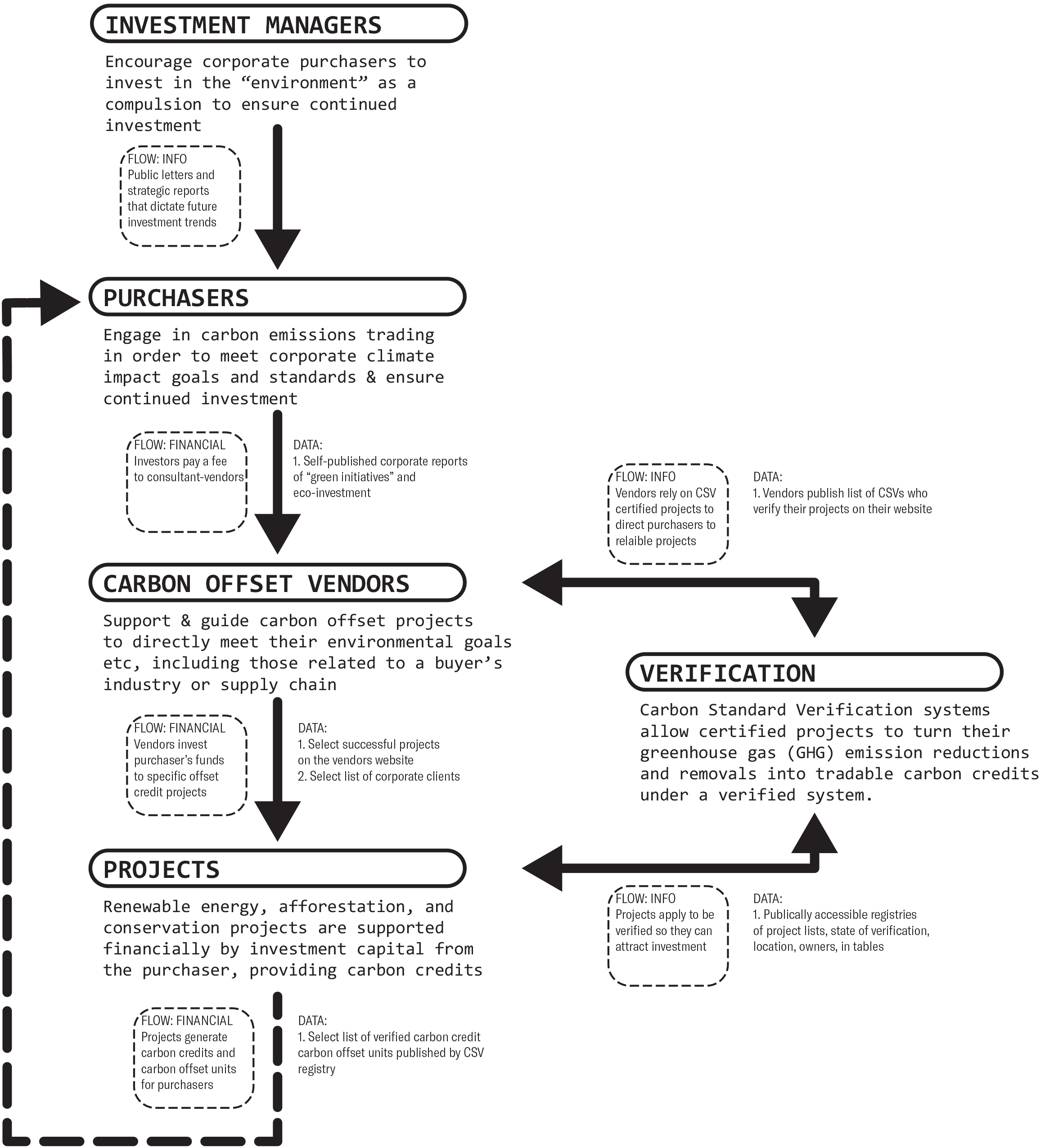

Every year Larry Fink, CEO of BlackRock, Inc., writes the single most anticipated piece of writing by the global financial community. This year, the theme was climate change. Released in January 2020, Fink states BlackRock would reconsider investing in any company that doesn’t take sustainability seriously. Fearing divestment, companies like Delta, Amazon, and Microsoft, have turned to large scale carbon emissions programs (and other ecological investment initiatives), as a compulsion to ensure continued investment. Fink acts not out of conscience, but because the greatest risk to the market economy is climate instability.

The result is an emissions trading market incentivized by threats of financial divestment and fear of market destabilization. With no government oversight, it leads to a condition of often unverified, potentially corrupt projects that may or may not exist.

1. As stated, the initial objective of the convention was to create a framework “to achieve, in accordance with the relevant provisions of the Convention, stabilization of greenhouse gas concentrations in the atmosphere at a level that would prevent dangerous anthropogenic interference with the climate system” (UNFCCC, 9)

2. Referred to as Annex 1 countries.

3. The Byrd–Hagel Resolution was a United States Senate Resolution stating that the US should not sign a climate treaty that would ‘mandate new commitments to limit or reduce greenhouse gas emissions for the Annex 1 Parties, unless …[it]… also mandates new specific scheduled commitments to limit or reduce greenhouse gas emissions for Developing Country Parties within the same compliance period’, or would result in serious harm to the economy of the United States. This effectively prohibited the US from ratifying the Kyoto Protocol.

“Black-rock-hq.jpg” by Americasroof is licensed under CC BY-SA 3.0

“Black-rock-hq.jpg” by Americasroof is licensed under CC BY-SA 3.0

CASE 1: Delta to TIST

In response to Fink’s letter, Delta Airlines 4 , vows 50% carbon neutrality by 2050, and makes a first investment of $100,000 to purchase carbon offsets for flights to and from Las Vegas, during the 2020 Consumer Electronic Show. Despite claims of transparency, the money travels through opaque channels, from dense urban centres to remote agricultural territories, passing through CAAC3, Grow Clean Air, I4EI4, TIST5, and others.

By tracing the flow of capital inside carbon offset programs, we expose the space between claim and action. Our objective is to make legible, visible, and transparent the vocabulary of spatial and financial practices mobilized in the name of carbon emissions reduction. Through CASE 01, we will trace the flow of money from the Delta Airlines to remote agricultural territories, passing through carbon offset vendors and US christian missionary tree planting pyramid schemes.

CAAC is one of the oldest carbon vendors in the US, started in 1993, and TIST’s activities seem simple: the planting of trees as a carbon sink. However, the details of organizational structure, regulation, and practice, suggest many trees are not planted, group members may not be paid for efforts, and the claimed carbon emissions reductions may be falsified. Both the opacity of practice and the valuation of trees to an emissions market are fundamental to building a tactical vocabulary of emissions trading oversight.

“The trees are almost like a bank” (02:25)

Source: TIST.org, Ripple Images

Using TIST geo-coordinates for thousands of member small groups’ afforestation efforts in Tanzania, we both visualize the financialization of nature by emissions trading, and reveal the machinations of Delta’s offsetting: how funds travel internationally when there is a lack of national regulation and transparency.

Currently, the map shows every audited TIST tree planting site in Tanzania. The map can be viewed in three lenses, one showing the financialization of trees, and two that allow you to see the structure of the tree planting organizations- Small Groups of farmers that report to a Group Cluster. The monetary value of the trees is based on the recent valuation of forestry carbon credits at $5.10 / tCO2e, multiplied by the number of trees, and the age of the trees in the grove.

We aim to expand this map to include all TIST afforestation efforts in the four countries where these programs exist - Tanzania, Kenya, Uganda, and India. We also aim to imbed higher resolution imagery and raster tiles to the map which will allow us to compare and validate TIST grove data with more precise ground imagery.

About Us

karbonfunkc.io is a climate activist research collective. We are concerned with the future accountability of climate finance, at a time where global mitigation of carbon emissions often overlooks the precarious economic flows that facilitate them. We identify the dangers of carbon offsetting, in the way it enables corporate actors to claim ecological reparation while continuing to practice environmentally detrimental actions. Our work visualizes the expanded financial investment system of emissions trading and the US’s international footprint for emissions mitigation. By tracing the flow of capital inside carbon offset programs, we expose the space between claim and action. Our objective is to make legible, visible, and transparent the vocabulary of spatial and financial practices mobilized in the name of carbon emissions reduction. Through the creation of a web platform, we will create an original, undocumented and urgent body of spatial research that publicizes flows of carbon capital, in order to hold greenwashing corporations and investors accountable.

Citations

BlackRock. “A Fundamental Reshaping of Finance.” Accessed April 10, 2020. https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter

CAAC “Clean Air Action Corporation.” Accessed February 12th. 2020. https://www.cleanairaction.com/

Dr. Martin Cames (Öko-Institut), Dr. Ralph O. Harthan (Öko-Institut), Dr. Jürg Füssler (INFRAS) Michael Lazarus (SEI), Carrie M. Lee (SEI), Pete Erickson (SEI), Randall Spalding-Fecher (Carbon Limits). How additional is the Clean Development Mechanism? Analysis of the application of current tools and proposed alternatives. Berlin: March 2016. PDF file.

ICAO Environment. “Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).” Accessed February 24, 2020. https://www.icao.int/environmental-protection/CORSIA/Pages/default.aspx

Investopedia Inc. “Investment Dictionary: Carbon Credit Definition.” Retrieved May 5, 2020. https://www.investopedia.com/terms/c/carbon_credit.asp

Paris Agreement to the United Nations Framework Convention on Climate Change, Dec. 12, 2015, T.I.A.S. No. 16-1104. available from https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement

Pascual, Daniel Fernández and Alon Schwabe. (2017). ‘The Offsetted,’ E-flux architecture, Positions.

Rogers, Heather. Green Gone Wrong: Dispatches from the Front Lines of Eco-Capitalism. London, UK: Verso, 2010. Print.

Sorkin, Andrew Ross. (2020, January 14). BlackRock C.E.O. Larry Fink: Climate Crisis Will Reshape Finance. New York Times. https://www.nytimes.com/2020/01/14/business/dealbook/larry-fink-blackrock-climate-change.html

Tist.org. “The International Small Group and Tree Planting Program.” Accessed February 14, 2020. https://www.tist.org//i2/

UNFCCC.int. “United Nations Carbon Offset Platform.” Accessed February 20, 2020. https://offset.climateneutralnow.org/

Verra. “Verified Carbon Standard.” Accessed April 21, 2020. https://registry.verra.org/app/search/VCS